RM 8500 x 12 refer Third Schedule. According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-.

Taking this pay rate and multiplying it by the number.

. For applicable employees any clause in an employment contract that purports to offer less favourable benefits than those set out in the. Employment law in Malaysia is generally governed by the Employment Act 1955 Employment Act. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed.

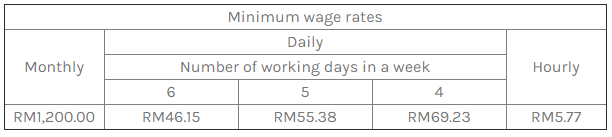

Annual Salary After Tax Calculator. A gross pay 22 X working days. The main legislation relates to minimum wages in Malaysia are National Wages Consultative Council Act 2011 Act 732 Minimum Wages Order 2020.

10 days of salary per year of employment 2 - 5 years. Malaysian law on paid and unpaid leave. To calculate the daily rate you can divide the monthly salary by either of.

60A 2 60A4a of. A worker cannot work more than 8 hours per day and more than 48 hours per week. An employee monthly rate of pay is always fixed to 26.

A worker cannnot work for directly for 5 hours non stop without a minimum rest time for 30 minutes. Subject Formula Example Ordinary rate of pay daily pay Monthly pay eg minimum wage number of working days ordinary rate of pay RM1000 26 days RM 3846 Hourly rate pay Daily pay normal hours of work hourly rate pay RM 3846 8 hours RM 480. Fixed Number of Days.

Say an employee earning RM 1900 who has worked for 6 years is about to get retrenched. Less than 2 years. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -.

Any employee as long as his month wages is less than RM200000 and. In Malaysia overtime is still popular among companies especially in the FB sector. Hi 1how to calculate the salary for an incomplete month for new staff.

50050 Kuala Lumpur Malaysia. Malaysias minimum wages policy is decided under the National Wages Consultative Council Act 2011 Act 732. The Employment Limitation of Overtime Work Regulations 1980 provides that the limit of overtime work shall be a total of 104 hours in any 1 month.

The Malaysia retrenchment benefits for EA-eligible employees are as follows. 15 days of salary. Part IX Maternity.

20 days of salary. Working days in Current Calendar Month including public holidays. For an incomplete year the calculation will be on a pro-rata basis to the nearest month.

What are the statutory deductions from an employees salary. And Sarawak have their own laws eg Sabah Labour Ordinance and Sarawak Labour Ordinance. RM50 8 hours RM625.

Divide the employees daily salary by the number of normal working hours per day. An employee weekly rate of pay is 6. 3 to 5 years 18 days.

RM 6000 RM 2500 RM 8500. 03-2031 3003 Fax 03-2026 1313 2034 2825 2072 5818 E-mail. Monthly Salary Number of days employed in the month Number of days in the respective month Overtime rate.

Here this would be RM625 x 15 x 2 hours RM1875. Section 60D 1 of the Employment Act 1955 states that an employee is entitled to paid holidays on eleven of the gazetted public holidays and any other day appointed as a public holiday under Section 8 of the Holidays Act 1951. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

Calculate your income tax in Malaysia salary deductions in Malaysia and compare salary after tax for income earned in Malaysia in the 2022 tax year using the Malaysia salary after tax calculators. 2what formula to use to calculate monthly salary. Malaysian Labour Law.

The Employment Actsets out certain minimum benefits that are afforded to applicable employees. Despite the pay rate shall be 1 ½ times the hourly rate of pay of employees some employers found it rather economical to required employees to. If the employees salary does not exceed RM2000 a month or falls.

Any employee employed in manual work including artisan apprentice transport. Malaysias basic labour law for Employers. Basic Allowance Incentive 26 days 8 hours.

EPF Employer Contribution. Replied by munirah on topic Salary calculation. To manually calculate unpaid leave you should ensure that Record Unpaid Leave in Payroll is not ticked under Settings Payment Settings.

14 days with pay. This is applicable whether the employees are paid on a daily rate or on a monthly basis. There is a tripartite body known as the National Wages Consultative Council which is formed.

Regulation of Employment Regulation of Employment is part of the Malaysia Labour Law which also consists of Salary Act and Statutory Holiday Table of Contents Regulation of Employment 1. Employment 1 to 2 years. 5 years and above.

The Law governs the terms and conditions of employment such as working hours holidays and rest periods wages overtime and other employment conditions. For normal working days an employee should be paid at a rate of 15 times their hourly rate for overtime work. Above 5 years 22 days.

B gross pay 26 X working days. Then divide the ordinary rate by the number of normal work. In this case the weekly pay rate result is obtained by dividing your yearly salary by 52.

Salary Formula as follows. RM 5500x 12 calculation by percentage. How to Perform Salary Calculator Malaysia.

But overtime can be a very confusing matter. The employee shall be paid at a rate not less than 15 times the hourly rate of pay. The Labor Law in Malaysia is regulated mainly by the Employment Act of 1955.

This means an average of about 4 hours in 1 day. RM 5500 x 11 refer Third Schedule. Working hours permitted under Akta Kerja 1955.

200 of his hourly rate of pay for work done in excess of his normal hours of work. In this article we will study the laws governing the hours of work and overtime work for employees under Malaysias labour laws. Then calculate the overtime pay rate by multiplying the hourly rate by 15 and then multiply that figure with the number of overtime hours worked.

First calculate the daily ordinary rate of pay by dividing the monthly salary by 26.

What You Need To Know About Payroll In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

Payroll Processing Steps Payroll Legal Services Payroll Software

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Payroll Processing Service By Rk Management Consultant Rkmc Rk Management Consultant Rkmanagementconsultatn Rkmc Payroll Management Workforce Management

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

What You Need To Know About Payroll In Malaysia

Your Step By Step Correct Guide To Calculating Overtime Pay

Company Registration Services In Gurgaon Company Registration Services In Gurgaon Payroll Management Process

Estabalishment Compliance Business Management Compliance Management

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Formula Calculate Salary Calculator Excel Template